Icici Bank Fixed Deposit Rates

Posted : admin On 4/1/2022

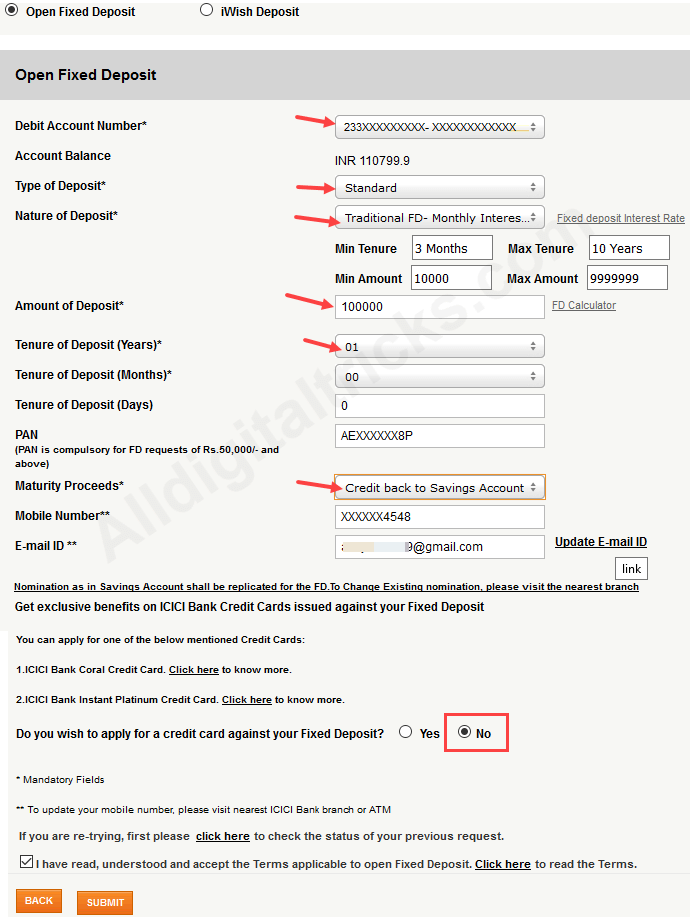

ICICI Bank fixed deposit schemes provide assured returns along with factors like growth, flexibility and protection. Investors who are looking for extra benefits along with wealth creation can choose from a range of products offered under its flagship term deposit, i.e. The quickest way to apply for a HiSAVE Fixed Rate Account is by logging in to internet banking, clicking 'Open a HiSAVE Fixed Rate Account' and completing the form. Alternatively you can call us 24/7 on. ICICI Bank Fixed Deposit Interest Rates. Maturity period Interest rate with effect from June 16; Public: Senior citizen: Seven to 14 days: 2.75%: 3.25%: 15 to 29 days: 3.00%: 3.50%: 30 to 45 days. (5years 1 day upto 10 years) 5.50%. More Rates Service Charges.Interest rates at 4% per annum for end of day balances equal to or above INR 50 lacs and 3.50% per annum for. Highlights of ICICI Bank FD Interest Rates (Under Rs.2 Crore) Highest ICICI Bank FD rate: 7.75% p.a. (above 2 years to 3 years) Tax Saver Fixed Deposit rates: General Public: 7.25% p.a. Senior Citizens: 7.75% p.a. Range of ICICI Bank Deposit rates: Maturity bracket available: 7 days to 10 years; Tenure for Tax Saver FD: 5 years.

ICICI new FD rates: Many banks have been lowering their deposit rates citing surplus liquidity. Now, ICICI Bank, a private sector lender has revised its fixed deposit rates, applicable form today.

Also, Earlier this month, on June 4, ICICI Bank had cut interest rates on savings account deposits of less than ₹50 lakh to 3%, a reduction of by 25 bps as against 3.25% earlier. Likewise, for deposits of ₹50 lakh and above, the account holders will earn an interest of 3.50%, down from 3.75%.

Currently, banks have ample liquidity and comparatively less demand for loans due to the lockdown. This has put pressure on deposit rates.

Starting from an interest rate of 2.75% on FD deposits between 7 days to 14 days, ICICI Bank is currently offering 5.15% on deposits between 1 year to 389 days. Customers get 5.35% on FDs with maturity between 18 months days and 2 years 5.35% which rises to 5.50% on deposits of over three years.

Senior citizens get an additional interest rate of 50 basis points across all maturities.

ICICI Bank FD rates on deposits below ₹2 crores (general public):

7 days to 14 days 2.75%

15 days to 29 days 3.00%

30 days to 45 days 3.25%

46 days to 60 days 3.50%

61 days to 90 days 3.50%

91 days to 120 days 4.10%

121 days to 184 days 4.10%

185 days to 210 days 4.50%

211 days to 270 days 4.50%

271 days to 289 days 4.50%

290 days to less than 1 year 4.75%

1 year to 389 days 5.15%

390 days to < 18 months 5.15%

18 months days to 2 years 5.35%

Fixed Deposit Rates For Icici Bank India

2 years 1 day to 3 years 5.35%

3 years 1 day to 5 years 5.50%

5 years 1 day to 10 years 5.50%

5 Years (80C FD) – Max to ₹1.50 lakh 5.50%

ICICI Bank FD rates on deposits below ₹2 crores (senior citizens):

7 days to 14 days 3.25%

15 days to 29 days 3.50%

30 days to 45 days 3.75%

46 days to 60 days 4%

61 days to 90 days 4%

91 days to 120 days 4.6%

121 days to 184 days 4.6%

185 days to 210 days 5%

211 days to 270 days 5%

271 days to 289 days 5%

290 days to less than 1 year 5.25%

1 year to 389 days 5.65%

390 days to < 18 months 5.65%

18 months days to 2 years 5.85%

2 years 1 day to 3 years 5.85%

3 years 1 day to 5 years 6%

5 years 1 day to 10 years 6.3% (ICICI Bank Golden Years FD)

5 Years (80C FD) – Max to ₹1.50 lakh 5.50%

Icici Bank Fixed Deposit Rates

ICICI BANK UK PLC – We are authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority (Registration Number: 223268).

We are covered by the Financial Services Compensation Scheme (FSCS). The FSCS can pay compensation to depositors if a Bank is unable to meet its financial obligations. Most depositors – including most individuals and businesses – are covered by the scheme.

Icici Bank Fixed Deposit Rates Singapore

In respect of deposits, from 30 January 2017, an eligible depositor is entitled to claim up to £85,000. For joint accounts each account holder is treated as having a claim in respect of their share so, for a joint account held by two eligible depositors, the maximum amount that could be claimed would be £85,000 each (making a total of £170,000). The £85,000 limit relates to the combined amount in all the eligible depositor’s accounts with us including their share of any joint account, and not to each separate account.

State Bank Of India Fixed Deposit Rates

For further information about the compensation provided by the FSCS (including the amounts covered and eligibility to claim) please ask at your local branch, refer to the FSCS website or call the FSCS on 0800 678 1100 or 020 7741 4100. Please note only compensation related queries should be directed to the FSCS.