Deposit Check Online

Posted : admin On 3/22/2022Your accountholders want instant access to their deposited funds. Strengthen your relationship with them by delivering the funds availability they expect, when they want it.

Immediate Fundssm from Fiserv is an instant check cashing platform that will help you deepen relationships by offering your customers or members instant access to funds when they deposit checks through teller, mobile and ATM channels.

For any check amount from $25 to $100, a $2 fee will apply to each check. If the check is returned due to insufficient funds, PNC will not debit your account. If your deposit is completed before 10 p.m. ET on a business day, your funds will also be available to pay checks or items during nightly processing. Immediate Funds sm from Fiserv is an instant check cashing platform that will help you deepen relationships by offering your customers or members instant access to funds when they deposit checks through teller, mobile and ATM channels. Immediate Funds lets you meet a pressing demand from small businesses and consumers across all demographic groups – while generating revenue for your. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement for other terms, conditions, and limitations.

Immediate Funds lets you meet a pressing demand from small businesses and consumers across all demographic groups – while generating revenue for your institution as a value-added service. You can count on Immediate Funds to deliver convenience for accountholders and goodwill for your institution.

An instant cashing platform that delivers the differentiated consumer experience the market demands

Deposit Check Online Wells Fargo

Customer Convenience

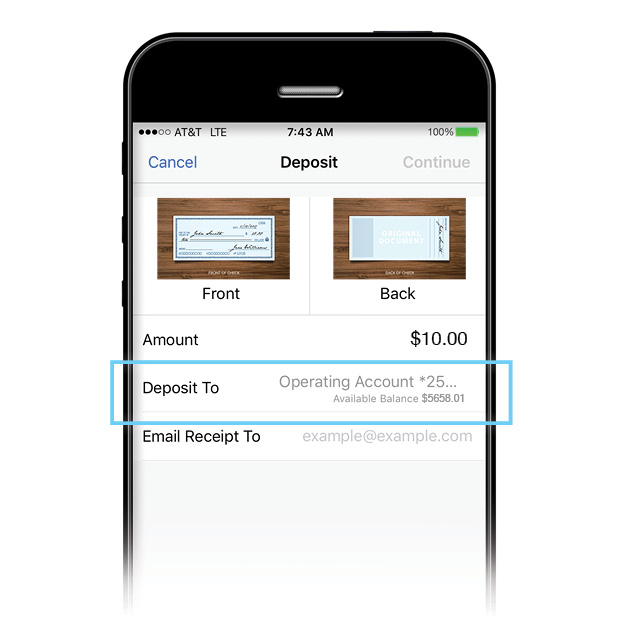

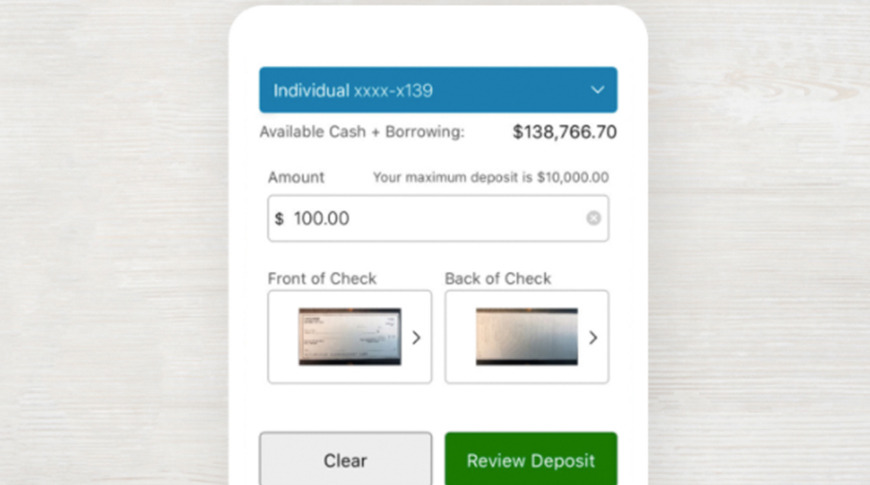

Delivered quickly through your existing mobile and ATM channels, and in-person at the teller line

Immediate Response, No Declines

Unique configuration allows accountholders to receive an offer of accelerated funds availability within seconds only when they've been pre-approved

Data Protection

Less worry for today's savvy consumers who are increasingly concerned about their personally identifiable information (PII)

Consistently High Approval Rates

Our model automatically attempts to approve the first transaction for every accountholder to grow adoption

Real-Time Delivery

Decisions on availability are immediately delivered to your staff, avoiding line delays or accountholder wait time

Easy Implementation

Requires no software installation and can be applied to all relevant points of check presentment

With Immediate Funds, you can provide faster access to funds from check deposits, giving them a more convenient way to access their funds at your financial institution rather than at an alternative financial service provider. Your financial institution retains complete control of the accountholder relationship via communications, branding, promotion and delivery.

Cash in on Convenience

Consumers want their financial institutions to offer immediate-funds services.

Related Content

Helping Consumers Clear the Check Clearing Hurdle

Deposit Check Online Bank Of America

Changes in consumer behavior are an opportunity for financial institutions to deepen their relationships with accountholders by delivering available funds solutions to meet their immediate needs.

Read the articleImmediate Funds Demo

Immediate Funds routes check deposit transactions through a decision engine that offers your customers instant check cashing in exchange for a fee.

Deposit Check Online Fidelity

Watch the videoDeposit Check Online Bank Of America

Immediate Funds

A need for instant availability of check funds creates competition for financial institutions. View the brochure to improve your position against non-bank entities.

Read the brochureWhy Your Small Business Strategy Needs to Address Checks

In an era of mobile payments and online banking, checks – and the availability of funds – are still the lifeblood of small businesses.

Read the articleThank you for your Interest

We will route it to the appropriate member of our team and they will respond within two business days.

- Prepaid Debit

Mobile Check Load

Load checks to your Card with your phone, using the Netspend® Mobile App.

Card usage is subject to card activation and identity verification.

You can load checks to your Card Account at your convenience without the hassle of waiting in line. Once the Card Account is funded, the money is yours to spend. And, it’s as simple as taking a few pictures.

How It Works

Here’s how to start using Mobile Check Load on your phone:

- Download the latest version of the Netspend Mobile App

- Select “Mobile Check Load” from the menu to the left

- Follow the on-screen instructions

You’ll be guided through how to take pictures of your check and given information about your loading options. In some cases, your money will be available in minutes!(fees may apply)

The Netspend Mobile App is available on Apple® mobile devices and Android™ phones.

Ready to change the way you pay?

Order a Card today, and you’ll receive it in the mail within 7-10 business days.

Direct Deposit

Get paid up to 2 days faster with Direct Deposit

Have your paycheck or benefits loaded to your Card Account.

Optional Savings Account

PUT SOME MONEY ASIDE

It never hurts to save some money, and you can earn interest, too.

Send Money

SEND AND RECEIVE FUNDS

Transfer money to your friends and family.